Contents

From 2009, evolution has been a constant in ithought’s journey. Balaji is a passionate equity investor with 14 years’ of experience in financial markets. He has in depth expertise across various functions in Asset Management and Wealth Management.

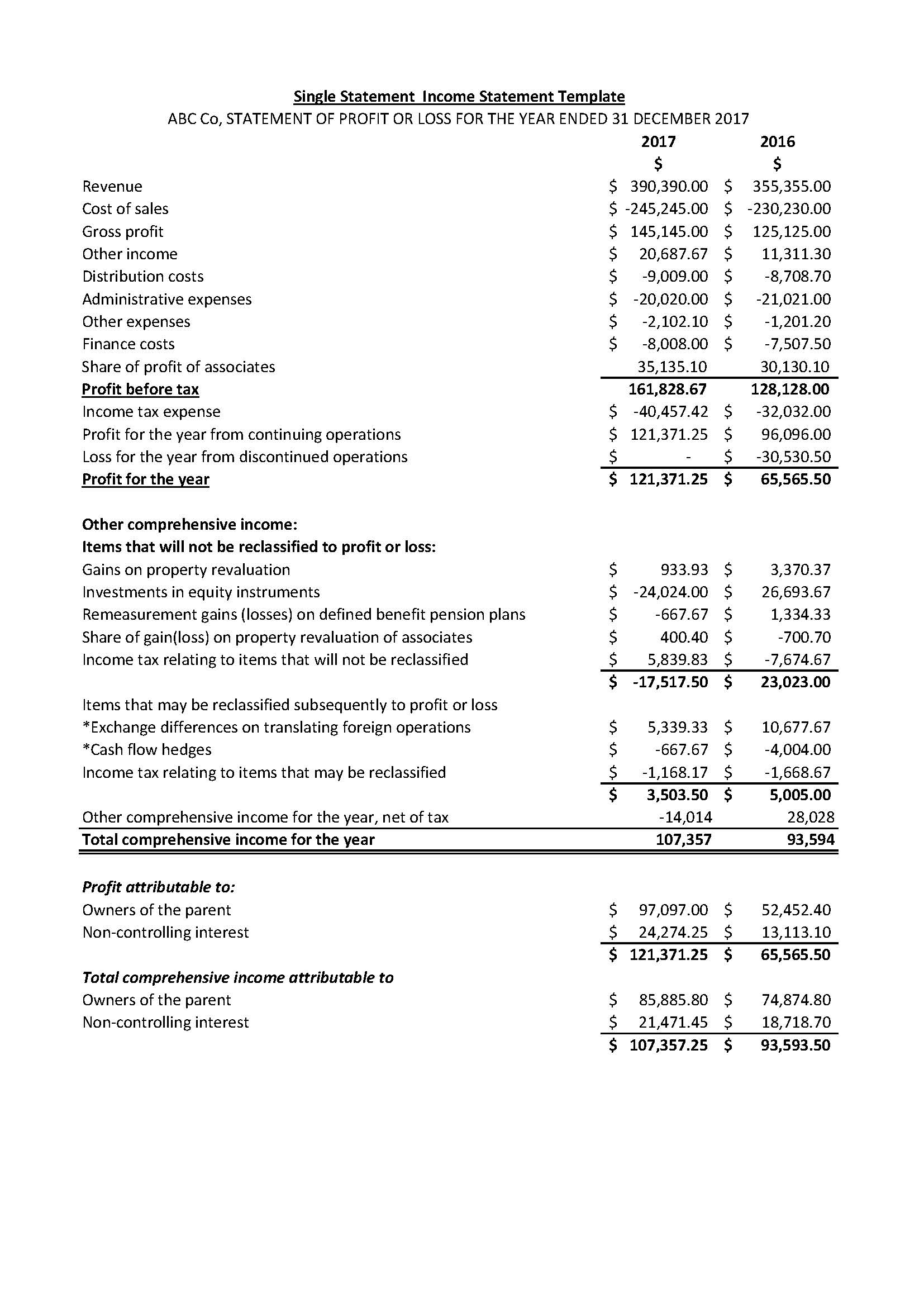

Below is the list of the banks with their respective CET 1 ratios. I have learnt much more in this decade as an advisor than I did in my previous two as an investor. Today, ithought has strong domain expertise in financial planning, mutual fund research, investment advisory, equity research, equity advisory, and portfolio management. We are now a SEBI registered investment advisor and SEBI registered portfolio manager.

His value systems in client service are closely aligned with ithought’s and he joined us in 2015. The depositors’ assets are more valuable than the company’s own finances at the time of dissolution. Before the bank can manage the assets of its depositors, CAR ensures that there is a layer of safety in place for the bank to manage its own risk-weighted assets.

banking

In addition, he has cleared the FRM certification exam from GARP . Niranjan has an avid interest for financial markets and has been following equity markets since his school days. Niranjan has been involved with strategy at ithought for over seven years now. Banks seem to have emerged stronger from the Covid pandemic as the total Tier 1 capital, a key measure of banking strength, reached $10.38 trillion, an increase of 4.7% year on year. The minimum Tier 1 capital needed to enter the 2022 ranking also reached an all-time high of $556 million. In addition, aggregate total assets have broken the $150 trillion barrier for the first time at $154.21 trillion.

The norms are prescribed to ensure that banks are adequately capitalised. It consists of the bank’s supplementary capital including undisclosed reserves, revaluation reserves, and subordinate debt. The ratio is helpful in determining financial soundness of banks in absorbing a reasonable amount of loss. Roshan acquired a bachelor’s degree in BCom with specialization in Finance and Accounting from Vivekananda college prior to working with us. Roshan has a keen interest in financial markets and is passionate about value investing.

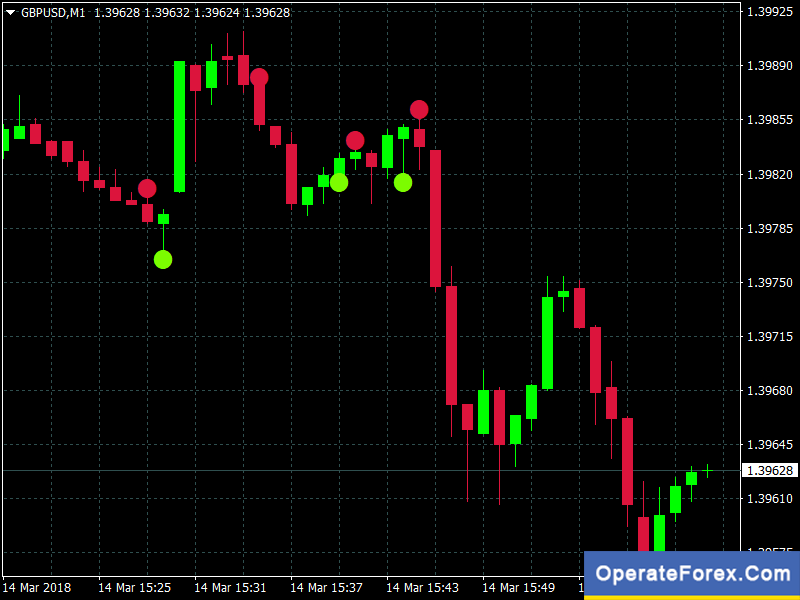

Preference shares are similar to equity shares, however, owners are given a specific payout instead of a portion of the profits. In an insolvency scenario, preference shareholders will be paid before equity shareholders. This provided more insight into their activities and allowed for more informed investment decisions. Banking regulations varied drastically across member countries. However, the requirement for improved governance and regulation remained. The solution was to authorize the banking regulator of each country to implement these rules.

Global Investment

Hybrid securities carry features of both debt and equity instruments and may further be classified into upper and lower capital . Minimal capital requirements for lending transactions was specified as 8% of RWAs. If a registered bank is incorporated in New Zealand, the minimum standards apply to the bank’s financial reporting group. It is the capital adequacy if the registered bank is a branch of an overseas bank. The bank is safe if the national regulator requires a capital adequacy ratio of 10%. However, if the required ratio is greater than 15%, the bank may face regulatory action.

It measures a bank’s core equity capital as against its total risk-weighted assets. Private sector banks hold equity capital in excess of the regulatory requirement . The impact of excess capital in banks is examined through a partial adjustment approach with unbalanced panel data for listed Indian banks from 2006 to 2017. Findings reveal that banks hold excess capital ratios, and private sector banks actively manage higher capital ratios than the public sector banks. The speed of adjustment for private banks is much higher than for public sector ones, and an inverse relationship between non-performing assets and change in equity capital is found.

Minimum Adequacy Ratio

Basel III is part of the continuous effort to enhance the banking regulatory framework. It builds on the Basel I and Basel II documents, and seeks to improve the banking sector’s ability to deal with financial stress, improve risk management, and strengthen banks’ transparency. Shyam Sekhar is the ideator and founder of ithought Financial Consulting LLP. He is an active and renowned value investor with over 30 years of experience in financial markets. His focus as an investor has been on identifying investment opportunities in emerging companies through a sound research driven process. In India, tier 2 capital consists of reserves and hybrid securities.

It aimed to reduce their size and limited the scope of activities. The spotlight shifted to lowering risk rather than increasing profitability. While the earlier norms addressed legitimate risks, gaps became apparent during the 2007 financial crisis. Any framework is robust only when it is modified to address new challenges and risks. Aggregate total assets too have broken the $150 trillion barrier for the first time at $154.21 trillion.

“It has worked so far because India has shifted from a tabooed-economy to one which is driven by a healthy combination of savings and credit. However, the possibility of BNPL rising exponentially is doubtful.” Lastly, Tyagi acknowledged how the Bank-Fintech relationship is a positive-sum game. Both entities come with their own strengths and key values to the table. So, when such collaboration happen, both parties tend to benefit. Lower tier two capital is amortized linearly over the last five years of its life. Tier two capital cannot be more than 100 percent of tier one capital.

Furthermore, with the implementation of the Basel 3 measure, regulators tightened the requirements from the previous Basel 2 in order to avoid another crisis in the future. As a result, many public sector banks in India have fallen short of CET 1 capital, and the government has been gradually increasing these requirements in recent years. The treatment of items mentioned is subject to the conditions that the external auditors of the bank have not expressed any qualified opinion on them. This is for the purposes of determining banks’ regulatory capital. These bonds can get written down if the common equity tier 1 of the bank falls below 5.5 percent. Niranjan is an applied Mathematics Graduate from the College of Engineering, Guindy.

- Therefore, a bank’s weak position will involve the RBI and government merging with other banks.

- A limitation of using the leverage ratio is that investors are reliant on banks to properly calculate and report their tier 1 capital and total assets figures.

- She has worked as a Decision Analyst in the finance team of Bharti Airtel.

- That explains the criticality of capital and leverage in the scheme of things.

- It is a key measure of a bank’s financial strength that has been adopted as part of the Basel III Accord on bank regulation.

For example, if a bank lends money to three different companies, the loans may have different risk weightings based on each company’s ability to repay its loan. Credit risks also exist in off-balance-sheet agreements such as foreign exchange contracts and guarantees. These exposures are converted to credit equivalent figures and weighted similarly to on-balance-sheet credit exposures. Get access to our equity, fixed income, macro and personal finance research, model equity and fixed-income portfolios, exclusive apps, tutorials, and member community. While most of the banks in India have not issued any AT1 bonds, but there are always some outliers. Out of 20 PSU Banks and 13 Private Banks in India that we checked, only 12 banks have issued AT1 perpetual debt instruments.

Do Private Sector Banks Manage Equity Capital Competently Compared to Public Sector Banks?

There are instances galore where the lenders have just failed to make the cut in the past. That explains the criticality of capital and leverage in the scheme of things. The issuing bank has the discretion to skip coupon payments in case of losses for the period when the interest needs to be paid. The year 2009 seeded the idea of a professional firm focused in the personal finance space.

TaxCloud (Direct Tax Software)

For well-capitalised banks with CAR much higher than regulatory requirement, it could encourage increasing exposure. However, for capital-starved banks, the additional exposure will have to be of lower risk weights. Otherwise, they will not be able to maintain their CAR while reducing their leverage ratio.

Tier 2 capital can absorb losses if the bank goes bankrupt, providing depositors with a lesser level of protection. Unaudited reserves, unaudited retained earnings, and general loss reserves make up this category. This capital absorbs losses after a bank loses all of its tier 1 capital and is used to cushion losses if the bank is winding up. The write down of the AT1 Bond has sent cascading effect across the banking sector.

Namratha Jain is a qualified Chartered Accountant and has 5 years of experience in the accounting and taxation industry. She has worked as a Decision Analyst in the finance team of Bharti Airtel. She also has experience working as an Indirect taxation manager handling GST compliance. what is tier 1 capital She has a desire to learn new things which made her switch to a different profile in her career and joined ithought as a Financial Planner. Ultimately, the intent is to create a more resilient banking system by reducing and addressing potential financial or economic risks.

Prasath Raj has been with ithought from inception and has over twelve years of experience in financial markets. He is also a derivatives specialist and has extensive knowledge on equity shares and mutual https://1investing.in/ funds. Prasath is a voracious reader and leverages his extensive knowledgebase to provide unique insights. He utilizes these competencies to formulate sound investment strategies for our clients.